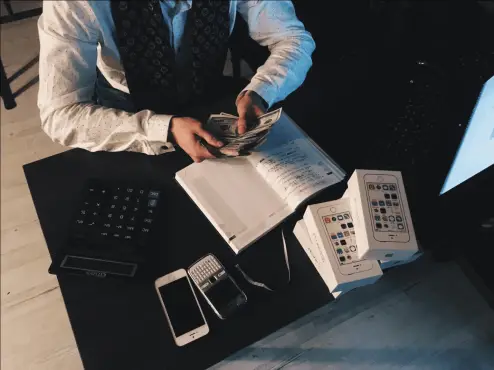

Did you know that employee theft costs U.S. businesses $50 billion annually? According to a report by the Association of Certified Fraud Examiners, 75% of workers confessed they had stolen at least once from their workplaces.

Although most of us who own businesses like to believe we do a great job screening our employees, the bitter truth is that almost all businesses have suffered from employee theft. Employees these days do not only steal cash; office supplies, merchandise, and even raw material are all fair game.

Therefore, you must take out an employee theft policy to cover yourself.

In this guide, we will learn:

- What is employee dishonesty insurance coverage?

- What do you do if you catch an employee stealing?

- Difference between loss sustained and loss discovery

- What does an employee theft policy cover?

- Losses not covered by an employee theft policy

- Can an employer sue an employee for stealing?

What is Employee Dishonesty Insurance Coverage?

Employee dishonesty insurance coverage, as the name indicates, is a type of insurance that protects small businesses from financial loss due to fraudulent acts committed by an employee. It is also sometimes known as a fidelity bond, crime fidelity insurance, or crime coverage.

Insurance coverage also defines who can be called an employee. The definition is pretty long-winded, but it refers to a person who has been working directly under the company for at least 30 days. Additionally, business owners, directors, and partners are not considered employees.

What Do You Do If You Catch An Employee Stealing?

If you discover a trusted employee has been stealing from you, your first instinct may be to go after them. Although the emotion is understandable, being angry means you can make a bad decision, which can make the employee sue you!

Therefore, you should first think it through.

Employee theft can be minor or something that can threaten your institution. The impact on your business will depend on the status of the person in your employment, the size of the theft, avenues to recover damages, and whether you properly lead the investigation.

To do things right, you need to:

- Conduct a fair and impartial investigation: If an employee is caught red-handed by direct witnesses, the investigation can be pretty straightforward. However, most thefts are discovered after the fact. In this case, the company management needs to gather the relevant data and interview the suspect and other employees.

- Recovering the damage: If it is discovered that the employee indeed committed the theft, they should be asked to return as much of the stolen goods as they can and come up with reimbursement for the rest of the losses. If the employee cooperates, you can give them a deal that no charges will be pressed against them. However, if the employee is uncooperative, you can take advantage of the help of legal counsel. Remember that the employer must do nothing that would compromise their rights against the employee who committed the crime.

- Filing a Lawsuit: Although this is not necessary, especially if your loss is small, companies can recover their losses through civil lawsuits against the employee.

Loss Sustained Vs. Loss Discovered

Crime coverage policies may be applied on a loss sustained or loss discovered basis:

Loss Sustained: In a loss-sustained policy, the theft will only be covered if the crime occurred during the policy period. Therefore, any employee theft that occurred before the policy came into effect and after it expired will not be covered.

Loss Discovered: A loss-discovered policy covers loss discovered during the policy period, regardless of when the theft happened. Suppose you started a loss discovery policy in June of this year, but an employee committed a crime in January, which was only discovered in the latter half of the year. In that case, it means the policy will cover you.

What Does Employee Theft Policy Cover?

The employee theft policy provides coverage if an employee steals money, property, and securities from small businesses. This also includes embezzlement, overinflating invoices from customers or vendors, or even taking home office supplies, like a laptop.

Here are a few things that the policy will cover:

- Stealing cash from the cash register.

- They are stealing a company’s product and selling them on the black market of Craig’s list while falsifying the company’s inventory count to cover the gap.

- Stealing company supplies over the years can add up to several thousand dollars worth of loss.

- A person from the accounting department transfers money from the company into her bank account, which goes unnoticed.

- They were robbing a safe from inside the premises.

- It is changing the figure in the paycheck for an amount higher than an employee’s income.

- They are fabricating bills for fake third-party vendors set up by the thieving employee.

- They are overinflating the bills of a vendor and taking bribes from the vendor.

- They are creating a company credit card account and using it for personal expenses.

- They are accessing customers’ confidential data and selling it to third parties.

- Submit timesheet hours for the time spent doing personal chores.

Losses Not Covered By An Employee Theft Policy

Aside from theft committed by company owners and principals, there is several other things that an employee theft policy does not cover:

- Principals of companies commit theft as they do not fall under the definition of employees.

- Employees who have a known history of committing theft.

- Salary and other benefits paid to the employee during the period he committed the crime.

- Legal expenses related to lawsuits.

- Inventory shortage’s proof of loss is based only on the profit and loss statement, not evidence of stealing.

- Loss of future potential sales due to theft.

- Indirect losses like potential income you could have earned if the money, property, or security was not stolen.

Can an Employer Sue an Employee for Stealing?

You can take legal action against an employee who has committed theft. Here are a few lawsuits you can file:

Breach of Contract: If an employee has violated a contract legally binding under state law, the employer can sue for damages from the breach of contract. Some instances involve employees stealing data and compromising trade secrets.

Limits of Noncompete Agreements: A business may be able to restrict an ex-employee’s ability to work for competing companies or start his own competing business for a certain period after leaving the employer.

Breach of Duty of Fidelity: Duty of Fidelity exists without a contract and stipulates that an employee must work in the company’s interest. You can sue an employee who stole from the company as it is against its interest.

Conversion Claims: If an employee has committed the theft of petty cash or merchandise, you can use them for conversion. Conversion is a tort that can help you sue the employee for depriving a business of its property without consent.

Bottom Line

Employee theft coverage is one of the most common types of commercial crime insurance. Suppose you suspect an employee is stealing from you. In that case, you should have the issue investigated immediately and be sure you have a business security camera installed. Hopefully, this guide will provide you with some help with how to deal with such a crisis.

Remember, though, to always consult with your lawyer before you start the process to ensure you are following the system the right way and will not do anything that will hold you liable to the suspected employee.